PAPER MONEY IS THE GOVERNMENT PROMISE - A PROMISE TO PAY A FACE VALUE OF BANKNOTES AND COINS

Money can be any item or confirmable record that is generally accepted as payment for goods. Money is also used for the payment of services and the repayment of debt such as taxes. Money is supposed to be a medium of exchange, a unit of account, a store of value, and sometimes a standard of deferred payment. The US dollar has been total fiat since 1971. The paper money is backed by nothing except a promise by the government to repay all of its debts. These debts will never be paid off.

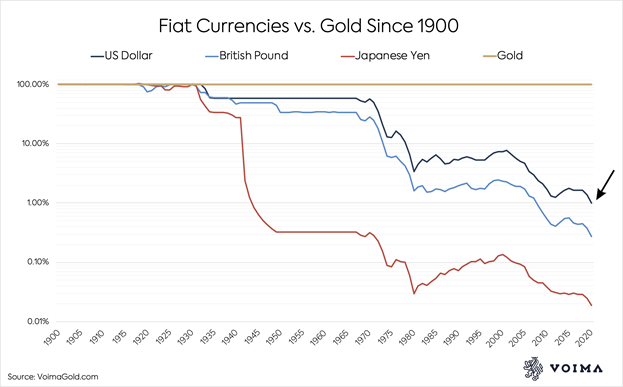

LOOK AT HOW THESE LEADING CURRENCIES HAVE LOST PURCHASING POWER IN THE PAST 50 YEARS:

In the chart, you can see that gold’s purchasing power is remarkably stable. As the gold price rises through time, it mainly compensates for fiat currencies being devalued versus goods and services. In other words, the price of gold goes up by the same amount that consumer prices rise. Gold even shows a tendency of increasing in purchasing power, which might reveal inflation numbers published by governments are too low. Another theory is that sound money, like gold, should rise in purchasing power as technological development makes goods increasingly cheaper to produce.

Fiat money is a currency, which includes coins and banknotes that are considered to be the legal tender from any government. The term ‘legal tender’ basically implies that a government of a nation will fulfil a promise to pay the bearer of a bank note the exact sum of the amount of money represented by the note. So, it’s like a certificate. The concept actually came from a time in history when the bearer of a bank note could be paid an equivalent amount of a precious metal, which was normally silver or gold.

The government decree authorizing this move was called a ‘fiat’, hence the name. Although fiat currencies gained popularity worldwide throughout the 19th and 20th centuries, in August 1971, the US government discontinued the gold standard and terminated the post-war Bretton Woods system, which maintained the position of the US dollar as an international reserve currency, which was backed by gold with a fixed price of $35 an ounce. By then, it had become impractical to justify a fixed price for gold as a commodity that was being traded actively in a vibrant global market.

WHY GOLD?

As investors seek ways to make their gold assets more liquid, we have created streamlined services where users can set up a bank account, purchase gold and then receive a debit card linked to their precious metal assets.

SAVE IN GBP, EUR AND USD

In addition to our ground-breaking gold currency, we also offer our clients the freedom to save in three of the world’s major currencies. You can exchange between them in seconds – on the move or whenever the rate is right. You will get access to wholesale market rates and low, transparent fees. Don’t be caught out by a currency meltdown – become BGB customer.

Spend abroad in more than 150 currencies

Use the BGB Mastercard to spend the money saved in your wallets in more than 150 currencies, anywhere in the world.

Cheaper than banks

You can manage your gold directly from your smartphone. Quickly, conveniently and reliably

No mark-ups on exchange rates

BGB helps you save money by allowing users to avoid any extortionate mark-up that is sometimes added to exchange rates by unscrupulous firms. You can move your money into GBP, EUR and USD and spend in any of the more than 150 currencies that Mastercard offers, with only a 0.25% transaction fee.

Gold in your smartphone

You can manage your gold directly from your smartphone. Quickly, conveniently and reliably.

Gold - a safe place in an unsafe world!

Subscribe to the latest updates

address

London, England,

Subscribe to the latest updates

address

London, England,

Subscribe to the latest updates

menu

address

British Gold Bank © 2025 All rights reserved